Climate change is the defining pressure of our century. Its influence, however, extends far beyond rising temperatures. It is a systemic accelerator that intensifies every major environmental and economic stress, from biodiversity loss to supply chain disruption, reshaping ecosystems, markets, and the global economy at pace.

The following discussion is grounded in unequivocal science, interconnected systemic risks, and an evolving regulatory landscape that is moving from voluntary disclosure to mandated action. For business leaders, this is no longer a distant environmental concern. Rather, it is a present-day strategic and operational imperative.

This reality is driven by a fundamental scientific truth: climate change does not act in isolation. It acts as a force multiplier, destabilizing other critical planetary systems. In turn, these disruptions intensify climate impacts. This circular dynamic means climate change amplifies other pressures, and other pressures amplify climate change.

This systemic threat is powered by critical feedback loops. Understanding these self-reinforcing cycles is not academic; it is central to identifying and mitigating the most material business risks.

- Weakened carbon sinks: Drought and heat damage forests and soils, which then absorb less CO₂, accelerating further warming.

- Accelerated emissions: Thawing permafrost releases vast stores of methane, a greenhouse gas far more potent than CO₂.

- Compounded physical shocks: Rising temperatures intensify droughts and floods, crippling the agricultural and infrastructure systems businesses depend on.

Consequently, a climate strategy focused solely on carbon accounting is insufficient. It fails to address how these feedback loops cascade risk across supply chains, markets, and operations. True resilience and competitive advantage requires an integrated strategy that simultaneously addresses climate, biodiversity, water, and pollution.

COP30 laid bare a key fact: climate action is a systems problem, not just a carbon problem.

The recent 2025 UN Climate Summit in Belém, Brazil, closed with a mix of progress and profound disappointment, revealing a world still struggling to align climate ambition with political and economic reality. Despite advances in adaptation finance, nature protection and carbon accounting, the central question of how quickly nations will phase out fossil fuels – the core driver of global carbon pollution – remains unresolved.

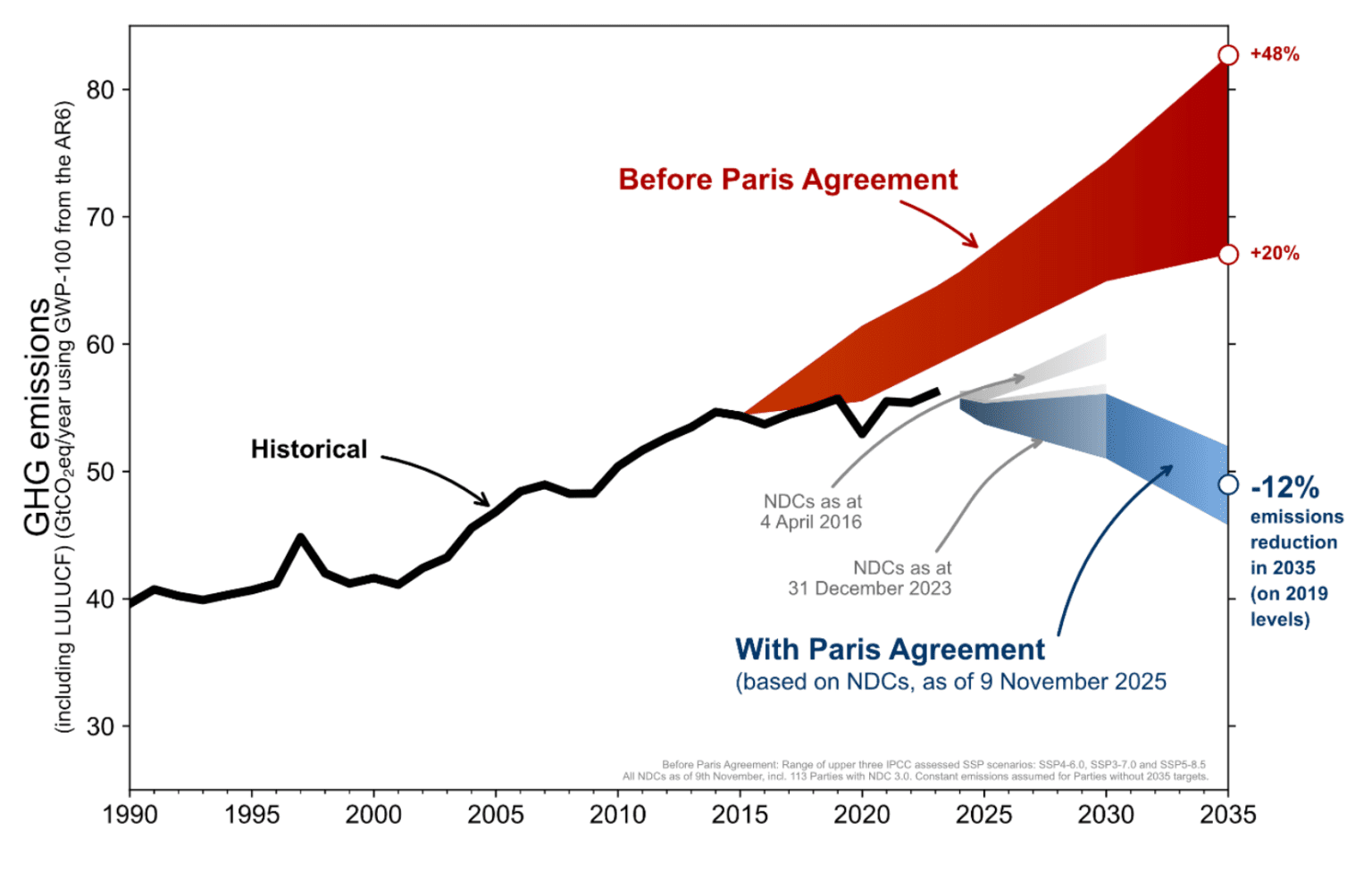

Ahead of COP30, countries were expected to submit new or updated Nationally Determined Contributions (NDCs). By the summit opening, 113 Parties had submitted plans covering nearly 80% of global emissions, rising to over 122 Parties by the end. The EU confirmed one of the most significant contributions, committing to a 66.25% – 72.5% emissions cut by 2035 based on 1990 levels, anchored in a 90% net-reduction target for 2040, setting a clearer path to climate neutrality by 2050. Several major economies, including Brazil, Japan, Norway, Singapore, South Africa, Switzerland, the UAE and the UK, also strengthened their plans.

Yet these pledges remain insufficient.

By COP30’s close, 119 nations (representing nearly three-quarters of global emissions) had submitted updated NDCs, but together they deliver less than 15% of the reductions needed by 2035 to keep warming to 1.5°C. UN analysis shows the world heading toward 2.3 – 2.8°C, well beyond safe limits. For context, without the Paris Agreement, emissions were expected to rise 20 – 48% above 2019 levels by 2035; current pledges instead deliver a modest 12% reduction below 2019 levels. This reveals an important truth: the Paris Agreement is bending the emissions curve, but far too slowly.

Attempts by more than 80 countries to secure a global fossil-fuel phaseout roadmap were blocked by petrostates, leaving the world without a shared plan to move beyond fossil energy. Negotiators instead adopted voluntary initiatives (such as the Global Implementation Accelerator and the Belém Mission to 1.5) which support national plans but avoid referencing fossil fuels.

The political dynamics were equally telling. COP30 saw the largest fossil-fuel lobbying presence ever recorded: over 1,600 lobbyists, outnumbering nearly every national delegation and exceeding the combined presence of the ten most climate-vulnerable nations.

Still, COP30 did deliver some notable shifts.

For the first time, countries formally acknowledged that the world is likely to overshoot 1.5°C and must limit both the scale and duration of that overshoot, bringing carbon removal, rapid decarbonisation and adaptation together in one urgent agenda. Carbon accounting also gained new strength, with governments reaffirming the Greenhouse Gas Protocol and ISO standards as the global backbone for credible emissions reporting, NDC design and carbon markets.

Finance and sectoral commitments also began to reshape the global trajectory, including adaptation finance aiming to triple by 2035, $1.3 trillion annual climate funding for developing nations, accelerating coal phaseouts, clean-energy investments and emerging transport-sector reductions. Nature-based solutions also advanced, especially through Brazil’s $6.7 billion Tropical Forests Forever Facility and expanded Indigenous rights protections – critical for safeguarding carbon-rich ecosystems.

Together, these signals show that carbon outcomes are increasingly governed by finance, sectoral shifts and systemic incentives, not just national targets.

In the end, COP30 will be remembered not for a fossil-fuel breakthrough, but for exposing the deeper structural realities shaping climate action. Cutting emissions is intertwined with financial systems, global trade, labour transitions, land rights, public health and entrenched industry influence. The defining question is whether global systems can transform fast enough to close the carbon gap before impacts become irreversible.

Our Take

COP30 confirmed a hard truth: the cavalry isn’t coming. With global policy trapped in political inertia, the responsibility to drive systemic change has decisively shifted to forward-thinking corporations and financial institutions. This is where strategy meets opportunity. The companies that will thrive are those that stop waiting for a perfect regulatory signal and start building their own self-reinforcing climate advantage: decoupling growth from volatile, high-emission systems. We help clients translate this dysfunctional reality into a competitive playbook, transforming systemic risks into strategic moats.

These system-wide lessons from COP30 will now shape the evolution of corporate climate action.

The lesson from Belém is clear: cutting carbon is no longer just about setting targets. It requires clear rules, accountability, and practical tools that operate across every part of an organisation. The frameworks that govern corporate action are evolving to reflect this systemic imperative.

First, the rules are becoming stricter and smarter. The Science Based Targets initiative (SBTi) V2 update introduces a more rigorous Corporate Net-Zero Standard, with simpler structures, clearer guardrails, and stronger assurance. Simultaneously, the Greenhouse Gas Protocol’s proposed Scope 2 update marks a fundamental shift: renewable electricity claims must now match real-world power use. This move toward grid-aligned, 24/7 accounting closes a major loophole and pushes investment into actual grid decarbonisation, not just contractual portfolios.

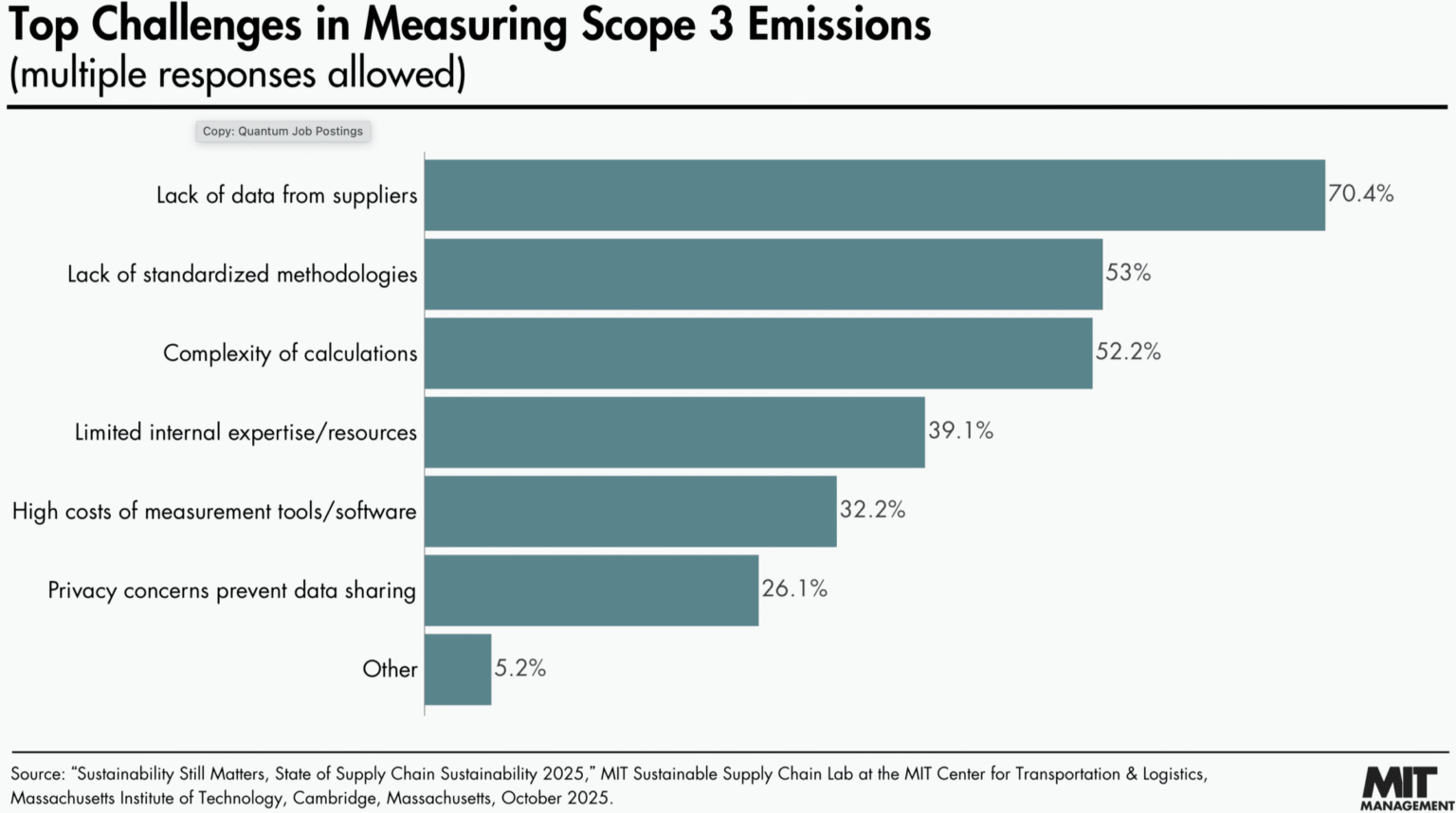

Second, the most significant challenges are systemic by design. While new Scope 2 rules tackle energy system accuracy, they highlight an even greater hurdle: Scope 3. These indirect emissions, often 70 – 90% of a company’s footprint, are difficult because they are not owned: they are embedded in the practices of suppliers, customers, and partners. The core challenge shifts from measurement to managing emissions you don’t control, demanding the collaborative transformation of entire value chains.

This drive for rigor is a direct market correction. It responds to widespread failures in previous mechanisms, most notably in the voluntary carbon market. Reports have shown that less than 10% of carbon offsets delivered genuine, lasting emission cuts, underscoring that superficial, transactional solutions are being decisively rejected. The subsequent market collapse proves that credibility now depends on verifiable, systems-level impact, not off-the-shelf accounting.

Our Take

The updates to SBTi and the GHG Protocol represent a fundamental and necessary market correction. Greenwashing is being systematically engineered out of the system. This isn’t a compliance shift; it’s a wholesale change in what constitutes credible climate leadership. We believe this is a clarity engine.

The push for grid-aware Scope 2 and the intractable nature of Scope 3 prove that a carbon strategy cannot be managed in a spreadsheet. It must be executed in the real-world systems of energy and value chains. We specialize in helping clients not just comply, but leverage these stricter, forward-facing standards to build unassailable credibility, attract precision green capital, and transform supply chain challenges into strategic advantage.

Regulation and Reporting: The Moving Target of Climate Transparency

Regulation is indeed evolving, but not always toward more stringency. On one hand, the CSRD remains central: if companies fall under its scope, they must report according to the EU’s disclosure standards. Under European Sustainability Reporting Standards (ESRS), climate-related disclosures such as total energy use, energy sources, and full GHG emissions (Scopes 1, 2 and 3) remain among the core data points.

But the regulatory landscape is shifting. Recent EU-level negotiations have introduced proposals to raise the thresholds determining which companies must report under CSRD, effectively narrowing its coverage. This change means fewer companies may be formally required to disclose detailed climate data. At the same time, alternate (often voluntary) frameworks like VSME are gaining traction among smaller firms and those newly excluded from CSRD scope.

Under the Voluntary Standard for Micro, Small and Medium Sized Enterprises (VSME), smaller businesses can still provide sustainability and climate-related information, but with lighter, more proportionate requirements. For example, VSME’s “Basic Module” covers energy use and GHG emissions, while a “Comprehensive Module” allows disclosure of climate targets, transition plans, and (if relevant) Scope 3 emissions, though these remain voluntary and depend on company size, sector and ambition.

This evolving duality reflects a broader shift: regulators are balancing between mandatory reporting for large firms and voluntary, flexible disclosure options for smaller ones.

On paper, climate change remains a major driver in corporate risk, investment and sustainability strategy; but in practice, fewer companies may be legally bound to disclose.

For businesses, the message is clear: regulatory compliance is becoming a fluctuating baseline, not a ceiling. Whether reporting is mandatory or voluntary, climate transparency is now a currency of trust demanded by investors, customers, and supply chains. Companies that proactively adopt robust disclosure and integrated risk management will gain a strategic advantage.

Our Take

The dilution of CSRD and other EU regulations scope is a red herring. It creates a dangerous illusion of reduced pressure while the actual demands from investors, supply chains, and consumers are intensifying. We guide clients to look beyond the regulatory baseline. Our approach transforms climate transparency from a compliance cost into a strategic asset, a currency of trust that secures partnerships and patient capital. In a fragmented landscape, we build the integrated data and narrative systems that make your action undeniable and your value proposition clear.

Conclusions on the new corporate climate reality

The thread is continuous: climate change acts as a system accelerator. It intensifies environmental feedback loops, exposes political and economic fractures, and is rewriting the rules of corporate accountability. This systemic pressure renders a strategy focused solely on carbon reduction not just obsolete, but a critical vulnerability.

The new imperative is Integrated Climate Resilience. This is no longer a niche sustainability concept but the central narrative for surviving and thriving in a destabilised world. It requires strategies that comprehend the interaction between carbon, water, nature, and supply chains; that are built on next-generation frameworks like SBTi V2 and grid-aware GHG accounting; and that leverage transparency as a core strategic asset, not a compliance cost.

This is precisely where we specialise. We partner with leadership teams to architect this resilience. We move organisations beyond carbon tunnel vision to manage interconnected pressures, transforming systemic risks into strategic advantage. We navigate the evolving frameworks not as an administrative burden, but as a blueprint for building a more valuable, defensible, and durable company.

Let’s build your resilient advantage.

References

Emma De Ruiter, COP30 marcada pela maior presença de sempre do lobby dos combustíveis fósseis. Euronews, 14/11/2025.

Directorate-General for Climate Action, What Did COP30 Achieve? European Commission, 01/12/2025.

David Waskow, Miriam Garcia, Jamal Srouji, Gabrielle Swaby, Gaia Larsen, Nathan Cogswell, Natalia Alayza, Mariana Oliveira, Melanie Robinson, Charles (Chip) Barber, Mirela Sandrini, Karen Silverwood-Cope, Beyond the Headlines: COP30’s Outcomes and Disappointments. World Resources Institute Insights, 25/11/2025.

Science Based Targets initiative. Developing the Net-Zero Standard. SBTi, 2025.

Mark Segal, SBTi Proposes More Flexible Corporate Net Zero Standard. ESG Today, 10/11/2025.

Emma Armstrong, Jono Adams, Thomas Hodgson, SBTi Releases Version 2.0 Draft of the Corporate Net-Zero Standard. Anthesis Group Insights, 31/03/2025.

Jennifer L, Study Finds Carbon Offsets Failing to Deliver Real Climate Impact. Carbon Credits, 10/10/2025.

Patrick Greenfield, Carbon Offsetting Market Collapses: What Happens to the Forests They Hoped to Protect? The Guardian, 06/11/2025.

Images

Image 1

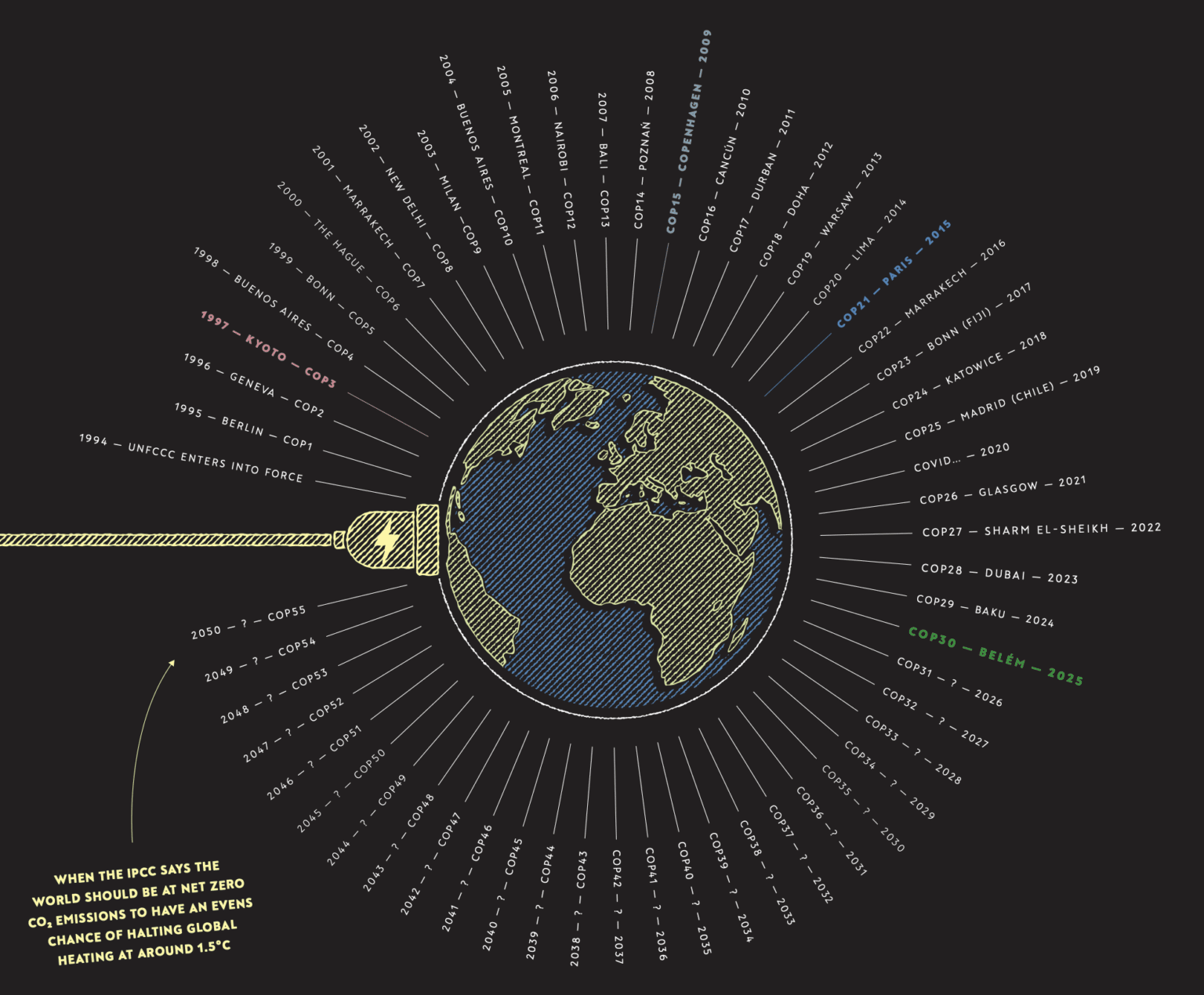

John Lang. COP30 Explainer Infographic. Energy & Climate Intelligence Unit, 2025.

Image 2

Shaswata Kundu Chaudhuri. COP30 Kicks Off With Eyes on Big Developing Countries. Carbon Copy, 11 November 2025.

Image 3

MIT Sustainable Supply Chain Lab. Sustainability Still Matters: State of Supply Chain Sustainability 2025. MIT Center for Transportation & Logistics, Massachusetts Institute of Technology, Cambridge, Massachusetts, October 2025.